The Outlook for Coal

- 2017-09-06

- 971

As noted by the International Energy Agency (IEA) coal supplies a third of all energy used worldwide and makes up 40% of electricity generation, as well as playing a crucial role in industries such as iron and steel. Coal is also very important for Mongolia, as it is one of Mongolia’s major exports.

The IEA notes that despite legitimate concerns about air pollution and greenhouse gas emissions, coal use will continue to be significant in the future. The IEA argues that greater efforts are needed by government and industry to embrace less polluting and more efficient technologies to ensure that coal becomes a much cleaner source of energy in the decades to come (International Energy Agency 2016a: 1).

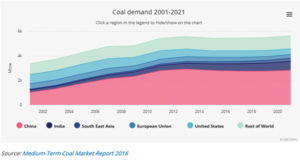

Despite suggestions that demand will not rise in the period ahead (see below), in the short term demand for coal seems quite strong. The IEA’s projections to 2020 are shown in Figure 1.

Short term demand for coal remains strong

Figure 1: World coal demand to 2020

Longer term demand scenarios are weak in terms of growth

In 2016 the International Energy Agency suggested that coal consumption will barely grow in the next 25 years, as demand in China starts to fall back thanks to efforts to fight air pollution and diversify the fuel mix (International Energy Agency, 2016b: 1).

But world coal production is declining

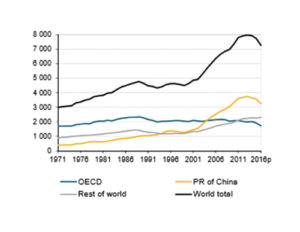

On the other hand, world coal production declined in 2014 for the first time this century. This decrease continued through 2015 and accelerated in 2016 to 458 Mt, or 6.3% lower, as combined production of all coal types fell to its lowest level since 2010.

This reduced level, however, was still 2.63 Gt (56.7%) higher than production in 2000.

Figure 2: World Coal Production, (Mt)

Source: International Energy Agency, 2017 Coal Information Overview p. 4

The dragon’s mood is a key issue

China is a big producer of coal and a big user of coal. China uses thermal coal for power generation and coking coal for steel production. Therefore, to the extent that China reduces or increases coal production, this influence coal (and iron prices). A rise or fall in China’s demand for coal will also influence coal prices.

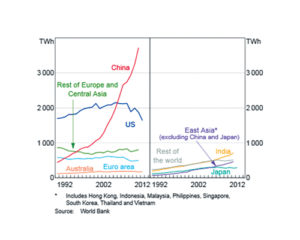

China’s is the world’ biggest user of thermal coal for electricity production

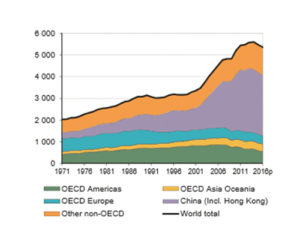

About 40% of the world’s thermal coal goes to electricity generation. China’s immense influence in the thermal coal market is reflected in Figure 3 below, which tracks use of coal for electricity production from the early 1990s, since when China’s use of thermal coal for electricity production has increased markedly. Indeed, China’s increasing demand for electricity, closely associated with China’s rapid growth in Gross Domestic Product over this period, was the major factor influencing world demand for thermal coal, as demand for thermal coal was subdued in other markets and declined in the United States from around 2000.

Figure 3: Coal-fired Electricity Generation – Annual

Source: Saunders. T., 2015. Developments in Thermal Coal Markets: 21

China remains the world’s largest coal producer but China’s production has fallen in recent years in response to air pollution concerns.

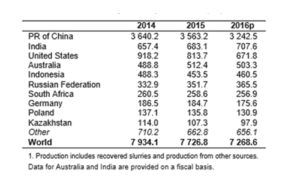

Table 1: World coal supplies by country (mt)

Source: International Energy Agency, 2017 Coal overview p. 4

The importance of China for world coal consumption is emphasized by Figure 4.

China now dominates world coal consumption and its importance as a market has grown markedly since the early 1990s when China began to open its markets and developed export oriented heavy industries, where electricity supplies were a key input.

Figure 4: World demand for coal

Source: International Energy Agency 2017: 7

Despite the decrease in coal consumption by China in recent years, China’s imports have risen to offset decreases in domestic production. There have also been supply interruptions in Ukraine from the conflict there, in Australia because of weather issues, while coal exports from North Korea have fallen because of UN sanctions on North Korea’s exports.

This has led to increased demand for coal from Mongolia. Mongolia’s coal production increased markedly in 2016. Indeed, in the short term, if these conditions persist, Mongolia’s coal sector has good prospects.

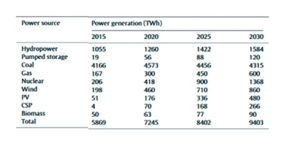

In the longer term, China is still a key influence. China is clearly aiming to change its energy mix away from coal to reduce air pollution. However, forecasts suggest thermal coal will still in heavy use for some time to come as shown in Table 2 below.

While China clearly has the policy intent to diversify to hydropower, gas and nuclear power, at least to 2030 thermal coal seems likely to remain in strong demand.

Table 2: China: forecast power generation by source to 2030

Source: Yuan et al. 2015 p.7

What does it mean for coking coal?

While the short term outlook for Mongolia’s coking coal exports looks good in price and quantity terms because of supply restrictions from other sources (initially including China, since eased somewhat), the longer term outlook is more unsettled. China is the key market for Mongolia’s coking coal, as is the case for thermal coal.

But even the short term market is volatile. In February 2017 the National Australia Bank noted that slowing Chinese construction activity in 2017 was expected to weaken steel demand, reducing, demand for iron ore and coking coal. In March, Reuters correspondent Clyde Russell also noted China’s approach to economic growth will be crucial for steel demand, with the market watching to see if Beijing would continue measures to stimulate infrastructure spending and construction, while at the same time shutting down excess steel capacity.

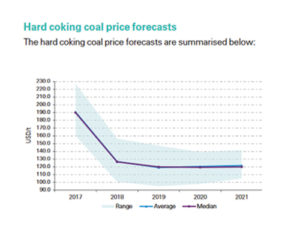

By April, Wood Mackenzie noted global coal markets were facing ‘extraordinary challenges and uncertainties.’ Wood Mackenzie forecast the benchmark metallurgical coal prices price to drop to US$128/t for the Q4 2016. Morgan Stanley also expressed concern about commodity markets being gripped by coking coal fever and noted “We’re actually still flat-to-bearish on the metallurgical coal price outlook.” KPMG’s August 2017 compilation of consensus hard coking coal forecasts arising from industry experts also suggests the price bonanza is running out of steam.

Figure 5: KPMG coking coal price forecasts, 2017

In summary, while supply restrictions have been good for Mongolia’s coking coal exports in the short term, the situation is volatile! Enjoy it while you can! In June 2017 the Australian Government’s forecast China’s metallurgical coal imports will decline by 11% in 2018 and by a further 12% in 2019. The outlook for metallurgical coal imports in China is expected to be impacted by moderating growth in domestic steel demand, as Beijing’s fiscal stimulus fades and activity cools in the construction sector.

The long term coking coal outlook for Mongolia is also China centric. Will China maintain its investment in infrastructure in the long term? Will China continue to diversify its economy away from heavy industry towards services (which may reduce demand for steel and coking coal)? And a bigger question, what will be the effect of China’s ‘belt and road’ initiative on demand for steel and coking coal? These are all good questions, for which good answers are few right now. We will just have to wait and see! n

By Paul Mills, Senior Economic Adviser, Chinggis Law LLC